FRAMINGHAM, MA – The question of whether or not the State of Massachusetts should rollback the MA Sales Tax to 3% is sure to bring voters to the polls this November — even if the task of deciding which candidates are the least objectionable has some disgusted with the “partisan politics as usual” races.

Question #3 seems harsh to some and more than fair to others.

The facts: Before 1966 there was no sales tax in Massachusetts. Facing a near $200 Million revenue shortfall, then Governor John Volpe, (a Republican who went on the become Nixon’s Secretary of Transportation when he left office in MA), passed a bi-partisan supported emergency regulation by which the legislature imposed a [temporary] 3% sales tax, (it seems its never hard to get politicians to compromise and cooperate when it comes to raising taxes — no matter how many campaign pledges they make, and regardless of which party they’re in).

In 1966 the main argument in Massachusetts’ “Great Tax Debate” was that if sales tax wasn’t imposed, either property taxes or the state income tax would have to be raised.

The tax regulations included a system of redistributing the sales tax revenue in the form of local aid to cities and towns, which in-turn reduced municipalities’ reliance on local property taxes to fund municipal services.

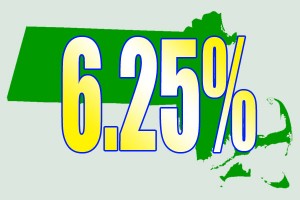

That was 45 years ago… the only thing “temporary” was the 3% figure. Last year, (in 2009), the MA State Sales Tax rate was increased from 5% to 6.25% and set the stage for this years taxpayer revolt.

While other sales taxes on alcohol, hotel rooms and meals were also increased — the retail sales tax increase was adopted over less popular “threatened” increases in state income tax or gasoline taxes.

Regardless of which other taxes or fees the increased sales tax staved off — or which services the tax increase aimed to save — sales tax is something everyone can relate to. From consumers to retailers, it’s simply seen as a few cents more for the State and few less for them.

Who wouldn’t want the sales tax reduced to 3%?

Fear-mongering politicians and political action groups always put the most susceptible victim in the cross-hairs of any well aimed campaign when they want [more] money.

T.V. Commercials warn that “our children’s education, teachers, police and fire personnel, medical services for the elderly and disabled [will all need to be cut]“.

Why is it always the money for worthy and innocent groups which is at risk? Do they keep the money for fat pensions, lifetime appointments with perk lined 6-digit salaries, overpriced no-bid contracts and other wasteful spending in some other pocket?

Why do we never hear them say; “Without this tax increase, I may have to pay for my own car to get to work next year“, or “This tax will help fund my brother-in-law’s no-show State job“.

After raising the sales tax during The Great Recession, and after knowing The Governor intended to give an old pal a $175k/yr unfilled, unnecessary job, or that he bought $17,000 curtains for his office, or that he claims to “need” a $1200/mo Cadillac SUV rented for him at taxpayer expense… or listening to how Charlie Baker opposes Question 3, although by his own account he pretty much single-handed raised insurance premiums from $1800/yr to nearly $4500/yr for MA families enrolled with Harvard Pilgrim Health — and earned himself a $1.7 Million salary doing it — or that Charlie was the Secretary of Administration and Finance during some of the Big Dig, (under then Governor Paul Cellucci), has to make the average voter wonder if there isn’t some fat to trim — and if the State’s problems are due more to spending than [tax] revenue.

It might be easier to accept the need for additional revenue if, next to articles about working class families on the verge of bankruptcy, or facing long term unemployment, we didn’t read about the seemingly bottomless trough of public money handed to politically connected contractors, consultants, friends and family members for things we don’t need and can’t afford.

Candidates from both the GOP and Democratic party will have to live down the extravagances that have disgraced members both parties — from Jane “I get to use the Helicopter” Swift to John “My $7M Yacht Lives in RI” Kerry.

With all the political money squandering, tax dodging, (and in the case of Mrs. John Tierney — offshore gambling and money laundering), how could anyone feel one cent of bad about cutting the MA State Sales Tax back to the 1966 rate of 3% ?

Be sure to ask your candidates their position on Question #3.

Resources:

MA Secretary of State Ballot Question #3 Info: http://www.sec.state.ma.us/ele/ele10/ballot_questions_10/quest_3.htm

“Vote NO on Question 3” group: http://www.votenoquestion3.com

“Vote YES on Question 3” group: http://www.rollbacktaxes.com/

###

Comments

2 responses to “MA State Election 2010 – Ballot Question #3”

Why is it always the money for worthy and innocent groups which is at risk?

That says it all!

This is a great summary. I posted a link to it on Facebook.

I want a new diet, called the “Beacon Hill Diet”. To understand how big the Massachusetts budget is at $28 Billion, Massachusetts would be #85 on the Fortune 500, bigger than any of these companies: 3M, Merck, John Deere, Apple Computer, McDonald’s, RAytheon, Bristol-Myers Squibb, Staples, Delta Air Lines, Xerox, Google, AFLAC, Amazon, EMC, Mass Mutual Life Insurance.

Notice many of these are Massachusetts firms. I wonder how many of them are happy to be taxed even more so Massachusetts can move up the Fortune 500 ladder?